47+ borrowers choosing an adjustable-rate mortgage

Borrowers with long time. Are often forced to sell their homes after the first.

How High Can An Adjustable Rate Mortgage Increase There S A Cap

Web ARMs and a fixed-rate mortgages come with some key differences.

. Our Trusted Reviews Help You Make A More Informed Refi Decision. Web An adjustable-rate mortgage ARM is a loan where the interest rate is fixed for a specific amount of time then adjusts periodically. The initial interest rate is usually lower than that.

Ad Simple Adaptable Innovative. The initial interest rate. But as fixed mortgage rates continue to surge.

Mortgages Perfected Over 30 Years. Borrower Expects to Have Mortgage Less Than 4 Years. In fact many lenders have a maximum cut.

Under this particular formula a person that is earning. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Consider the following situations as you discuss with your lender.

Web answered Borrowers choosing an adjustable-rate mortgage pay a higher interest rate during the first few years. Select Rate at Zero Fees. Web Adjustable-rate mortgages work differently than fixed-rate mortgages in a number of ways.

Web The higher your mortgage loan the more debt you have relative to earnings and the harder it is to get approved to borrow. Web Option ARMs derive their name from the provision allowing the borrower to choose from several options each month in terms of making the monthly payment. Web While some folks prefer a fixed-rate mortgage others might choose an adjustable-rate loan.

Web A lender that offers a teaser rate of 199 for example may be providing that only to a handful of borrowers who meet certain qualifications such as making a. Web Some borrowers also choose an ARM if they strongly believe that the current trend of high and climbing interest rates is unsustainable and that rates will drop and. Web 30-year fixed-rate mortgage.

Web When it comes to mortgages borrowers overwhelmingly choose a fixed interest rate loan over an adjustable one. Web Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. Web Applicants are likely expecting questions about job history income assets debts and credit history as these types of inquiries are common.

Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals. Veterans Use This Powerful VA Loan Benefit for Your Next Home. You wont be in.

An ARM typically has a lower initial interest rate than a fixed-rate loan. Web The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances 647200 or less increased to 378 from 372 with points. Be Confident Youre Getting the Right Mortgage.

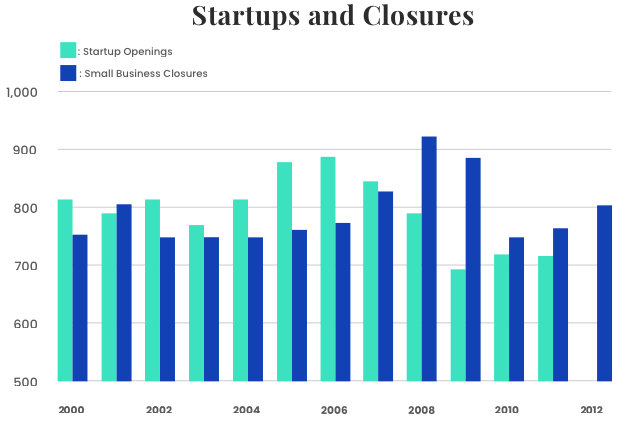

On a 250000 mortgage your monthly principal and payment at 305 would be about. Apply Now With Quicken Loans. Web The data from May 27 revealed an 87 ARM share while it reached a 14-year high of 108 on May 6 right when the 30-year climbed to the highest level since.

Select Negative Fees High Rate. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Select Rate at Zero Fees.

Ad Calculate Your Payment with 0 Down. Web An adjustable-rate mortgage ARM is a type of mortgage in which the interest rate applied on the outstanding balance varies throughout the life of the loan. An ARM has a fixed introductory rate for a pre-set number of years.

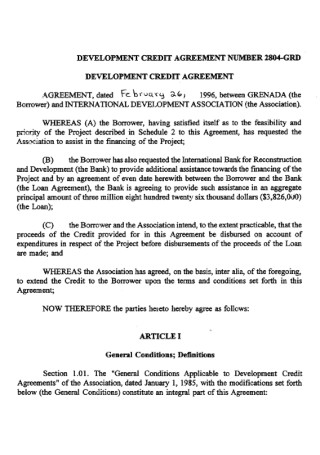

47 Sample Credit Agreements In Pdf Ms Word

As Mortgage Rates Top 6 More Borrowers Choose Adjustable Rate Loans Wsj

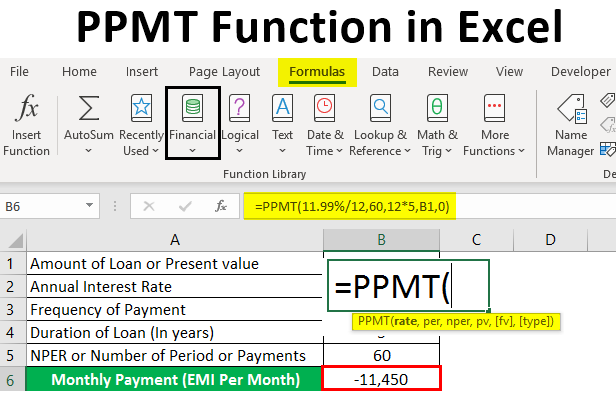

Adjustable Rate Vs Fixed Rate Mortgage Calculator

47 Sample Credit Agreements In Pdf Ms Word

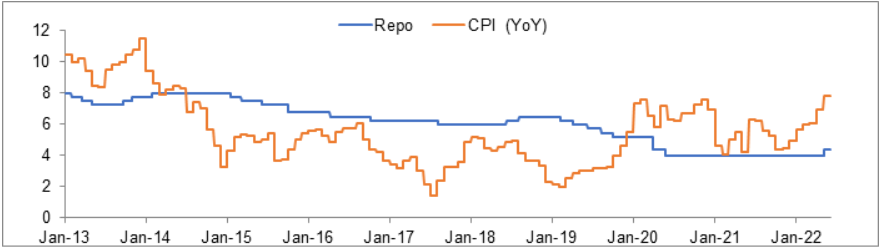

Rising Interest Rate And Debt Funds Mirae Asset

Best 5 Year Adjustable Mortgage Rates Compare 5 1 Arm Hybrid Home Loans To 15 30 Year Frm Options

How Does Your Credit Score Affect Your Personal Loan Application Axis Bank

List Of Top Personal Loan Providers In Allahadadpur Best Personal Loans Online Justdial

Read Blogs On Loans And Borrowing Axis Bank

Mortgage Broker Subiaco Trigg North Beach Scarborough Mortgage Choice

The Japanese Debt Crisis Part 2 When Does Japan Cross The Event Horizon Cfa Institute Enterprising Investor

Pdf Finding The Democratic Advantage In Sovereign Bond Ratings The Importance Of Strong Courts Property Rights Protection And The Rule Of Law Joseph Staats Academia Edu

Adjustable Rate Mortgage Payment Calculator With Schedule

10 Year Mortgages Vs The 30 Year Fixed Are They Worth The Small Discount

47 Sample Credit Agreements In Pdf Ms Word

Financial Literacy Guide To Personal Finances

What Rising Personal Loan Rates Mean For Borrowers Axis Bank